The blueprint for what is happening today was foretold in a speech given by Ben Bernanke to the National Economists Club, Washington, D.C. November 21, 2002. There was 5 main points to take from the speech. The first 4 have already happened, the last was if the other 4 didn’t work Bernanke would devalue the US Dollar.

The main points of Bernanke’s policy are as follows:

1. Lower interest rates to zero.

First, the Fed should try to preserve a buffer zone for the inflation rate, that is, during normal times it should not try to push inflation down all the way to zero.6 Most central banks seem to understand the need for a buffer zone. For example, central banks with explicit inflation targets almost invariably set their target for inflation above zero, generally between 1 and 3 percent per year. Maintaining an inflation buffer zone reduces the risk that a large, unanticipated drop in aggregate demand will drive the economy far enough into deflationary territory to lower the nominal interest rate to zero.

2. Buy securities from the banks to expand the Feds balance sheets

Second, the Fed should take most seriously–as of course it does–its responsibility to ensure financial stability in the economy. Irving Fisher (1933) was perhaps the first economist to emphasize the potential connections between violent financial crises, which lead to “fire sales” of assets and falling asset prices, with general declines in aggregate demand and the price level. A healthy, well capitalized banking system and smoothly functioning capital markets are an important line of defense against deflationary shocks. The Fed should and does use its regulatory and supervisory powers to ensure that the financial system will remain resilient if financial conditions change rapidly. And at times of extreme threat to financial stability, the Federal Reserve stands ready to use the discount window and other tools to protect the financial system, as it did during the 1987 stock market crash and the September 11, 2001, terrorist attacks.

3. Increase the money supply.

If we do fall into deflation, however, we can take comfort that the logic of the printing press example must assert itself, and sufficient injections of money will ultimately always reverse a deflation.

4. Buy our countries debt.

The Fed was able to achieve these low interest rates despite a level of outstanding government debt (relative to GDP) significantly greater than we have today, as well as inflation rates substantially more variable. At times, in order to enforce these low rates, the Fed had actually to purchase the bulk of outstanding 90-day bills.

…… Unlike some central banks, and barring changes to current law, the Fed is relatively restricted in its ability to buy private securities directly.12 However, the Fed does have broad powers to lend to the private sector indirectly via banks, through the discount window.13 Therefore a second policy option, complementary to operating in the markets for Treasury and agency debt, would be for the Fed to offer fixed-term loans to banks at low or zero interest, with a wide range of private assets (including, among others, corporate bonds, commercial paper, bank loans, and mortgages) deemed eligible as collateral.14 For example, the Fed might make 90-day or 180-day zero-interest loans to banks, taking corporate commercial paper of the same maturity as collateral.

……The Fed can inject money into the economy in still other ways. For example, the Fed has the authority to buy foreign government debt, as well as domestic government debt. Potentially, this class of assets offers huge scope for Fed operations, as the quantity of foreign assets eligible for purchase by the Fed is several times the stock of U.S. government debt.

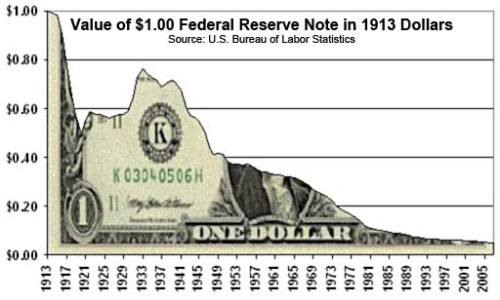

5. Devalue the dollar.

Although a policy of intervening to affect the exchange value of the dollar is nowhere on the horizon today, it’s worth noting that there have been times when exchange rate policy has been an effective weapon against deflation. A striking example from U.S. history is Franklin Roosevelt’s 40 percent devaluation of the dollar against gold in 1933-34, enforced by a program of gold purchases and domestic money creation. The devaluation and the rapid increase in money supply it permitted ended the U.S. deflation remarkably quickly. Indeed, consumer price inflation in the United States, year on year, went from -10.3 percent in 1932 to -5.1 percent in 1933 to 3.4 percent in 1934.17 The economy grew strongly, and by the way, 1934 was one of the best years of the century for the stock market. If nothing else, the episode illustrates that monetary actions can have powerful effects on the economy, even when the nominal interest rate is at or near zero, as was the case at the time of Roosevelt’s devaluation.

History has shown us that this has happened already in the past and is a weapon than can be used when all else fails. Well it looks as if we are coming to that point now as all else has failed. Previously the dollar was devalued by 40% and I’m sure we can expect something similar this time around.

New evidence has appeared given by Kyle Bass. Click here to see the post.

For further reading on dollar devaluation and expected bank runs check out the following articles

Paul Broadsky, Gerald Celente, Barry Ritholz , Gonzala Lira