Jim Willie is not one for holding back and in his latest interview with Silverdoctors sums up where the global financial system currently stands. With each passing week the situation worsens. Willie see a global financial collapse now close at hand and the endgame will be triggered by a small-medium sized bank failure in Europe.

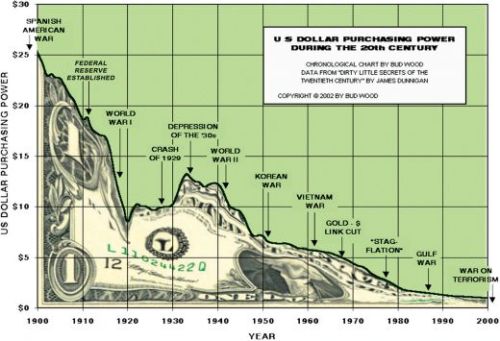

The European collapse will ignite a global Gold rush as the only remaining safe haven ultimately ending USdollar as worlds reserve currency.

The Doc began by asking the Golden Jackass what will most likely be the trigger event for a complete systemic collapse:

I don’t think we’re going to see a default as a trigger event in gold or silver. I didn’t say we won’t see a gold and silver default, I said that it won’t be the trigger. There are just too many deep sources for gold that the central banks have access to. I refer to Basel Switzerland, the Roman catacombs, and the BOE, I think they’re pretty close to the bottom of their gold barrel, but they have big powerful friends in Rome and Basel Switzerland.

The trigger is not even going to come from within the US, because it’s just so controlled- the markets are being controlled from multiple different centers, in particular the Federal Reserve and the Treasury Dept, JPM, Goldman Sachs.

It’s just so corrupt to the core, and we’re seeing a blossoming of the fascist business model and the corruption that’s accepted.

Attention should be drawn to Europe. Look at some of the most recent events that are really quite staggering.

The Italian elections kicked out the GSax preppy Mario Monti. I’m surprised that he’s not being thrown off a palace balcony. It’s directly in response to hikes that Monti imposed on property tax to finance the bankers! The Italian people have a much more effective political system than the US!

Italy actually has elected a comedian! This is like electing John Belushi to form a coalition government! Mario Monti is on the way out. What does that mean?

The defense of their dead banks with liquidity lines and property tax hikes will end in the near future!

In Spain you have new high level financial corruption events that have paralyzed the nation at a time when they’ve already seen a string of big financial firm failures!

This at a time where they have 25% unemployment. I think that the likelihood of violence on the streets is greater in Spain than in any other country.

Spain’s bank insolvency and wretched unemployment is causing tremendous distress, and there will be a breaking point there.

Then in France you have Hollande, the leader of the socialist clowns has raised the highest tax brackets to 90%. The resulting capital flight to Scandinavia is astounding, leaving the nation extremely vulnerable.

Then you have the German economic slowdown which is really capturing some attention, which will remove ability and patience of bank rescues.

Then you have the London banks which are joined by French banks in broad deep exposure to Southern Europe. They’ve set themselves up to have their heads cut off.

Recall that the Draghi solutions like LTRO were recently insulted by debt downgrades, which was unprecedented.

Then you have the USFed, which is the only buyer of USTBonds, and the Euro Central Bank as the only buyer of PIIGS Govt Bonds.

Here is a note as to the stress in the system: the European banking system received $1.2 trillion in Dollar Swap funds from the NY Fed in January alone to prop up the ECB banking system.

European banks are collectively much larger than the US banks, but are in suspended animation while the US banks are being supported by narcotics money laundering.

A big European bust is coming. When the European bust events occur, the mad scramble for safety will be on, and they’re not going to be looking for Switzerland any longer because of their Euro peg. A massive rise in the European gold price is coming and it will be staggering, shocking and not reversible. It will ignite a global Gold rush, a massive short covering rally, and powerful 30% to 50% rise in the gold price will come in response to the European collapse.

Following that will come the arrival of the Gold Trade Finance platforms. Gold settlement for trade across the world- primarily though coming out of the East.

In other words, trade involving two parties not involving the US, one of them being an Eastern nation, and they will settle not in dollars anymore, they will settle in gold, and they will have some help from their friends in Turkey.

We’re going to see an end to the USDollar reserve status following these events, and the funeral will have a speech given by the Saudis to bring an end to the Petro-Dollar itself.

You have to look to Europe and not to the US, the US is a joke in regards to crisis, management, propaganda, the ESF, narcotics money laundering, sponsored fraud, it’s just unbelievable what’s going on in the US, it’s not going to be the trigger, the trigger will be Europe.

We have 15 to 20 potential sites to force the breakdown. It’s not just one or two. Every couple months there are a few more potential areas to cause the breakdown. That’s very, very dangerous, and new. We didn’t see that 3-5 years ago. Back in 07 it was really just sub-prime. We have about 12 different areas now which are just as dangerous as sub-prime, and both of them are in Europe.

With QE4 and the recent return of NINJA loans as the Fed attempts to re-inflate the housing bubble, The Doc asked Willie whether the Fed would be able to kick the can down the road one more time with one last bubble:

They have 15-20 fingers and toes, but there are just too many different areas that they need to plug.

This real estate bubble is a joke. There’s no new bubble coming or even on the horizon. What we’ve got is the US government has sponsored a whole new round of sub-prime mortgages. Expect instead of the big banks underwriting them, it’s the Federal government. We have not seen a rebound in demand for housing, even though the 30 year mortgage rate is under 4% and has been for quite a few months.What’s not shown in the press is that there’s still 10 million homes that are sitting on the bank balance sheets. They’re called REO’s, and they’re selling their REO’s or short sales, which ARE NOT INCLUDED IN THE CASE SHILLER INDEX!

It’s a parallel of the discouraged workers no longer included in unemployment! They’re bringing labor market calculations to the housing market. They’re not going to revive the housing bubble for a simple reason- there’s not widespread finance available, it’s exclusively coming out of the FHA. The other reason is that people have a great distrust for buying homes after they saw so many people foreclosed on. Another reason is that the people don’t have brisk income.

The factors are not there, it’s kind of a lunatic claim to state that the housing market is going to be re-bubbalized. Not even close, it’s stuck in a depression!

The Doc asked Jim whether we face a lost two decades like the Japanese, or what type of collapse we face in the US:

I said this back when Lehman Brothers fell in the autumn of 2008. The US is on a path that cannot escape systemic failure and total dependence on the printing press to cover its debt and for a debt default of the US government debt, which will come in the form of a global conference to organize and co-ordinate the debt write down. There will be US military outside the room to make sure everyone complies.

If the US goes ahead with sequester cuts, they’re talking about $4 trillion over 10 years. I cannot emphasize how small that is. But let’s go through some of the points why I believe the collapse is at our doorstep:

The collapse is happening now- it’s no longer ultra-slow motion like 2 years ago. It’s a new event every few days or weeks. The pace is quickening.

The extreme nature of current events is alarming. Just in the last few months:

The US Fed announces every month their extension of 0% forever (denigrating their own exit Strategy talk).

$1.2 trillion was doled out by the USFed to European banks in January alone!

We have the Germans demanding repatriation of their official gold account (Allocated Accounts).

We have the Italians electing a comedian like John Belushi to halt the property tax hikes that bail out banks. This is an insult to their entire political system which experienced that Mario Monti appointment without an election.

We have the London banks recently sponsoring a Chinese Yuan Swap Facility, cow-towing to Asia. This is unprecedented! New York will not do such a thing, but London did, which means that London and NY might be at odds!

We have an attack announced on Mali in North Africa to wrest gold & uranium timed when the Germans asked for repayment of their gold reserves. The quantities really fit. There was a suspicious comment by the French and British saying it will be repaid in 7 years. 300 tons over 7 years is approximately what Mali produces in gold that will cover almost exactly the German repayment. That was organized by France and the US.

We have the shutdown of the gigantic Mongolian copper & gold mine by Rio Tinto which is an example of resource nationalism.

We have raids larger and bolder of the GLD inventory that prevents a COMEX default and will produce a bigger price discount vs. the spot for GLD shares. I think it will go down towards a 20% discount, which will cause alot of problems.

We have the USFed preparing for QE5 (or rather QE187, as in QE to Infinity).

We have events like the major central banks losing credibility while engaging in open currency war. The franchise system of central banks is being questioned. They’re in battle with each other.

We have the US facing a fiscal cliff, which forces a quantum leap in job cuts (recession alert).

We have the Japanese ratcheting up the competitive currency devaluations (only USTBond buyer).

We have the Swiss managing their Euro-Franc peg, but suffering losses in Japanese & British bonds.

We have the Russians hosting a G-20 Meeting to coordinate the alternative to US$-based trade.

THEY ARE NOT GOING TO CONTINUE WITH DOLLAR BASED TRADE SETTLEMENTS! NOT GOING TO HAPPEN!!We have the emergence of Turkey and soon India as gold trade finance intermediaries. They’re going to supply 1 of 2 parties engaged in trade with gold so they can make the settlement of the trade.

We have the Iranian sanctions coming to a conclusion in US acquiescence. The US is surrendering to the Iranians!

All these events have occurred just since the new year began less than two months ago! The pace of extreme events is quickening!Extreme events have become the norm, putting tremendous additional stress on the system which the boys are trying to manage. They don’t have enough people, enough resources, enough channels, and they don’t have enough brains to do it.

The managed system cannot succeed, it’s too complex. They are attempting to work towards a system of total system management, and it’s just not going to work.

A series of climax events is coming very soon. The changes will be rapid and breath-taking.

Vast wealth has been moving East the past 3-4 years, and with it great power.

Look for some seemingly minor bank failure to cause a ripple effect of deeper damage.

It’s going to involve larger banks tied with commitments such as counter-party contracts or intermediary supply functions, and things are just going to start wrecking.I think vast wealth is going to be lost in the US and the West, except by gold and silver owners.

Owning gold and silver will become harder to do because the rules are becoming stricter.

Those who have set themselves up in the last few years are going to be the big, big winners, and the ones who are bold enough and brave enough to do it now are going to be glad for their actions.I have a family member who refused my advice three years ago, and now that family member is facing the conversion of her very large privately managed IRA pension fund into these new special Treasury bonds. That’s going to cause a real firestorm by the public, and they’re going to wish that they had converted their IRA’s into a gold account.

Source: SilverDoctors