Great description of how the IMF destroys countries for the purpose of asset stripping.

IMF “Shock Therapy”

May 30, 2013

IMF asset, collapse, economic hitman, imf, shock therapy Comments Off on IMF “Shock Therapy”

Christine Lagarde Due To Be Charged In Connection With £270million Fraud and Embezzlement Scam

May 24, 2013

IMF christine lagarde, court, imf Comments Off on Christine Lagarde Due To Be Charged In Connection With £270million Fraud and Embezzlement Scam

IMF head Christine Lagarde is to appear in court to hear whether she is to face charges into fraud and embezzlement in relation to allegations that she interfered with a trail. Not just any trail, Bernard Tapie benefited to the tune of €400millon and the taxpayers had to fork out. Now we know why she is qualified to lead the IMF 😉

A French government minister last night called on Christine Lagarde, the head of the International Monetary Fund, to resign if she is charged with fraud and embezzlement.

She was questioned by magistrates in Paris yesterday over a £340million payout of public money five years ago to convicted conman Bernard Tapie.

As she appeared in court, there were calls for her to stand down from her high-profile £305,000-a-year job if she is charged.

Najat Vallaud-Belkacem, the Minister for Women’s Rights, said: ‘Knowing the IMF and the way this type of institution works, I tend to think that if she was placed under investigation, she would without doubt be asked to quit her post.’

Last night the court adjourned after 13 hours sitting but it was widely predicted Mrs Lagarde, 57, would be placed under investigation by the Court of Justice of the Republic, equivalent to a suspect being charged in the UK.

She faces allegations that she stepped in to settle a long- running legal battle in which Tapie claimed he was cheated out of millions by Credit Lyonnais bank over the 1993 sale of his sportswear company Adidas.

Mrs Lagarde ordered a panel of judges to arbitrate and they awarded Tapie 400million euros (£340million) in damages paid from taxpayers’ money. Prosecutors suspect Tapie received favourable treatment in return for supporting ex-president Nicolas Sarkozy in the 2007 presidential elections.

They have suggested that Mrs Lagarde – who was France’s Finance Minister at the time and the first woman ever to hold the post – was partly responsible for ‘numerous anomalies and irregularities’ which could amount to complicity in fraud and misappropriation of public funds.

There is no suggestion Mrs Lagarde profited personally in any way from the final settlement.

The affair has become a huge embarrassment to France and the IMF.Dominique Strauss-Kahn was forced to quit the IMF two years ago after being accused of trying to rape a hotel chambermaid in New York, charges which were later dropped.

Her grilling by prosecutors comes after police raided her £1million Paris apartment in March.

Mrs Lagarde’s lawyer, Yves Repiquet, said the inquiry was ‘in no way incompatible’ with her new job, adding that he expected the case to be dismissed.She has denied any wrongdoing, saying: ‘If it’s decided to continue with this inquiry it won’t be particularly surprising. Personally, it doesn’t worry me at all – I didn’t benefit personally.’

But it has been widely reported in the French media that investigators intend to charge her with fraud and embezzlement.

Le Monde reported that magistrates had already written to Mrs Lagarde to tell her not to expect any special treatment because of her high-profile international job.

Tapie was jailed for six months in 1997 for corruption and match- fixing while he was the owner of Marseilles football club.

IMF Tells Ireland No More Austerity Next Year

December 18, 2012

IMF, ireland 2013, austerity, economy, growth, imf, ireland Comments Off on IMF Tells Ireland No More Austerity Next Year

In October the IMF admitted that its Fiscal Multiplier(is not 0.5 percent but really 0.9-1.7) used for justifying austerity measures was wrong and in fact the implication was that austerity doesn’t work. Now shortly after Ireland announced the 2013 budget, the IMF has asked that Ireland does not implement austerity measure next year. It was worried that Irelands growth which is already weaker than forecast may hinder its ability to re-enter the bond markets.

IRELAND should not impose further austerity even if growth targets are missed next year, the IMF has said.

The agency also called on Europe to honour pledges to help make Ireland’s debt more sustainable, in its latest review of the country’s finances.

It outlined fears that growth may be weaker than expected during 2013 – but does not advocate more austerity.

Instead it advises the coalition that if it is failing to reach economic targets next year, it should not rush to bring in any further cutbacks, for fear of damaging any fragile growth. Instead the economic targets could be pushed out until 2015 to help recovery.

The IMF made the statement as it approved its eighth review of the bailout programme, authorising the release of a further €890m funding under the bailout terms.

It said Ireland had so far shown “steadfast policy implementation” with the conditions of the bailout programme, despite slower growth this year.

It is predicting more gradual economic recovery with growth of 1.1pc in 2013 and 2.2pc in 2014. But with many economists forecasting growth of less than 1pc in 2013, there is a real threat to Ireland’s chances of getting out of bailout and back to the markets as planned in 2014.

The IMF says that if growth is weaker than forecast and economic targets begin to slip, the Government should not introduce extra cuts or a mini-Budget. Instead the Government should wait until 2015 before taking extra measures, in order to protect whatever growth there is.

IMF deputy managing director David Lipton said: “The program with Ireland has now been in place for two years and the Irish authorities have consistently maintained strong policy implementation.

“The authorities have demonstrated their commitment to put Ireland’s fiscal position on a sound footing, with the 2012 deficit target expected to be met even though growth has been low.

“Nonetheless, if next year’s growth were to disappoint, any additional fiscal consolidation should be deferred to 2015 to protect the recovery.

“Continued strong Irish policy implementation is essential for the programme’s success,” said Mr Lipton.

In what may be a reference to the ongoing negotiations on repayment of Anglo Irish debt, Mr Lipton called on European partners to deliver on pledges to help Ireland.

“Ireland’s market access would also be greatly enhanced by forceful delivery of European pledges to improve programme sustainability, especially by breaking the vicious circle between the Irish sovereign and the banks.”

The IMF also said that the banking sector needs to be reformed and shored up to help improve lending. “Vigorous implementation of financial sector reforms is needed to revive sound bank lending in support of economic growth,” it said.

Source: Irish Independent

IMF Admits Austerity Doesn’t Work

October 20, 2012

IMF austerity, fiscal multiplier, imf Comments Off on IMF Admits Austerity Doesn’t Work

Probably one of the biggest stories this year and completely missed by the MSM has been the IMFs change of the fiscal multiplier, that it bases its austerity on, from 0.5 to 0.9-1.7%. This is for all practical purposes an admission that austerity does not work. Try telling that to the Irish, Greek, Portuguese, Argentinians and other countries worldwide that have been on the receiving end of the IMF’s policies.

Read more at http://globaleconomicanalysis.blogspot.com/2012/10/imf-admits-it-prescribed-wrong-medicine.html#DI5sYuUoQDPyZmOT.99

Is IMF short for I must fail?

Fiscal Multipliers are wrong, IMF admits – the biggest macro story this year

The big story this week is the International Monetary Fund’s (IMF) admission that the fiscal multiplier is not 0.5 percent but really 0.9-1.7 percent according to Financial Times article It’s (austerity) Multiplier Failure

This is actually not just big news, but massive news! For the IMF to let alone realize and then admit this is central to the outlook for growth and fiscal deficits across all economies. Let’s walk through the maths here:

The fiscal multiplier defines that 1 percent of austerity will net cost 0.5 percent of gross domestic product (GDP) – but now the IMF says it is higher. Hence, its whole approach of austerity at any cost is losing its academic as well as practical application.

If the fiscal multiplier is larger than 2.0 percent you have an extremely vicious circle. You are enforcing a diet which will kill the patient rather than heal him, as for every percent you reduce in spending you lose 2 percent in growth.

The bigger the hole you dig, the harder the climb back up! Do you think it is a random decision that the IMF made 1.7 percent the top of its range? Hardly!

The fact that only FT Alphaville in its “The IMF game changer” has spotted and written about this is close to being scandalous. It tells us that the Anglo Saxon press’ need for supporting Keynesian initiatives (buying time, maximum interventions and pretend-and-extend) at all costs is done for political reasons rather than for finding real solutions to this crisis which is now spinning out of control as systemic risk is at an all-time high.

The IMF has increased the systemic risk by extending the payback period of central planners’ calculations (much lower growth and higher fiscal/structural deficits). The market knew this, but it is such naive forecasts produced by the IMF which dictate policy recommendations for the debt crisis. The IMF is ironically seen as the ‘expert’ although it has experiences considerably more failure than success in its “helping efforts” – think Asian Crisis, Russia, EU debt crisis! The IMF is asking for your patience – extend-and-pretend squared is here!

It is sad that it took this long though! This has been discussed at length before by me (interview in April with TradingFloor.com), plus in the FT (whose writers deserve much credit). The most prominent voice on this topic has been Soc. Gen’s excellent economic team led by Ms Michala Marcussen – who I happened to study with a couple of ‘wars’ ago at the University of Copenhagen.

What we need now is for policymakers to start producing credible forecasts which politicians cannot misuse. The IMF started this, so will the Federal Reserve, European Central Bank and Bank of England take note? Will the Congressional Budget Office in the US reduce its growth forecast? (See link for how this has been done in the past). Probably not, but the IMF’s admission this week is a game changer. You can’t save yourself to prosperity, not even in the eyes of central planners anymore! The IMF admission also proves what we have known for a long time: Macro stinks!

Finally, and most importantly, this creates a need for something new – which is the very theme I keep emphasizing. Let’s work on creating the fundamentals for the micro economy which will create more jobs. The strongest multiplier, after all, remains taking one person out of the unemployment queue and putting them into a job. This reduces the subsidies needed as the person earns a taxable salary, is probably less ill, feels better, spends more etc. So the real challenge the IMF and other central planners need to realize is: You can help, but only by going away and taking a holiday. The S&P 500 (excluding financials) has a Return on Equity (ROE) in excess of 20 percent this year. It is based on an economy growing at 2.0 percent! So, do you need more proof?

President Clinton is in growth terms one of the most successful US presidents in history. What did he do politically for eight years – except for smoking cigars? Nothing! Belgium was without a government for almost two years and every single macro indicator improved during this spell. I rest my case! Let’s have total radio silence for five years and we will all be in a better place!

Mike Shedlock goes on to say

Wrong Medicine In terms of governments doing nothing for five years (as in no more stimulus) I am in agreement, if that is what Steen means (but I am not so sure that’s precisely what he means). Nonetheless, while were at it, let’s get rid of Fed meddling as well.

As for the multiplier theory, the IMF is now saying it prescribed the wrong medicine.

What was a .5 multiplier is now a range of .9 to 1.7. Anything close to or above 1 means austerity can never work.

No doubt, Krugman will be crowing “I Told You So” over this, but there is not an Austrian economist anywhere that was in support of the massive tax hikes we have seen. Reduction in government spending was not the problem. Rather massive tax hikes and lack of badly-needed reforms was the problem.

Certainly what we know is austerity cannot work “as implemented” but I said that years ago. We have seen massive tax hikes and few work rule and pension reforms. We needed lower taxes, less government, and massive work rule reforms (and still do).

Blaming the problems on “austerity” will get a lot of sympathy from Keynesian clowns, but they cannot distinguish good medicine from cow patties.

Source: http://globaleconomicanalysis.blogspot.com/2012/10/imf-admits-it-prescribed-wrong-medicine.html

Christine Lagarde The Hypocrite

May 30, 2012

IMF christine lagarde, greece, hypocrite, imf, tax, tax free 4 Comments

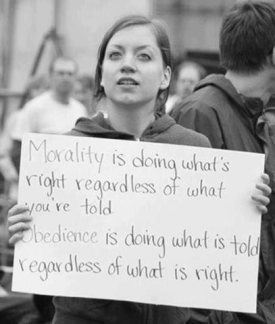

Last week Christine Lagarde famously kicked Greece in the balls, telling them to shut up and pay more taxes, while all the while SHE PAYS NO INCOME TAX. Here was what she said

“As far as Athens is concerned, I also think about all those people who are trying to escape tax all the time. All these people in Greece who are trying to escape tax.”

…..

she added that they could “help themselves collectively” by “all paying their tax,” and agreed that it was “payback time” for ordinary Greeks.

The Independent reports as follows

It was called her “Let them eat cake” moment. Now Greece will be saying: “Make her pay tax”.

The IMF chief Christine Lagarde was accused of hypocrisy yesterday after it emerged that she pays no income tax – just days after blaming the Greeks for causing their financial peril by dodging their own bills.

The managing director of the International Monetary Fund is paid a salary of $467,940 (£298,675), automatically increased every year according to inflation. On top of that she receives an allowance of $83,760 – payable without “justification” – and additional expenses for entertainment, making her total package worth more than the amount received by US President Barack Obama according to reports last night.

Unlike Mr Obama, however, she does not have to pay any tax on this substantial income because of her diplomatic status.

I just love the double standards the elite have 😉

IMF’s Track Record And Tactics

April 9, 2012

IMF asset, christine lagarde, destroy, imf, rob, steal, strip Comments Off on IMF’s Track Record And Tactics

Anyone with an understanding of the IMF knows it leaves countries worse off after it leaves than before it came. This week Christine Lagarde is in the US looking to raise a further $500 billion to pump into Europe. James Corbett explains it little further above it previous adventures and how it deliberatly destroys a country so it can be raped.

In the 1990s the IMF put “stipulations” on their loan package for Brazil that required amendments to the country’s constitution, and then lobbied extensively for those changes. Between the start of IMF involvement in Peru in 1978 and the second round of loans in the 1990s, the appropriately acronymed SAP (structural adjustment program) managed to quadruple illegal coca production by devastating local farmers and leaving them to choose between growing coca or starving. They chose coca.

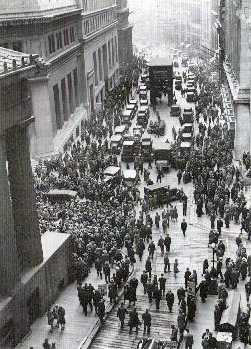

There are countless other disasters. And countless swindles. Billions of dollars in IMF loans to Russia in the 1990s were diverted straight into the Swiss bank accounts of oligarchs and gangsters. One $4.8 billion dollar loan program administered by the fund in 1998 went in one door of the Russian central bank and straight out the other. The people never saw a ruble of it and were left with unemployment rates, stock market losses and currency devaluation that rivaled the Great Depression.The fallout from these operations is invariably the same. The people figure out that they’ve been footed with the bill for someone else’s party and the riots begin. We’ve been witnessing this in Europe since the Euro crisis began and it’s flaring up again. This week a 77 year old Greek pensioner shot himself in the head outside parliament because, he said, he didn’t want to have to start picking through trash in order to feed himself. The IMF issued a statement Thursday that it was “deeply saddened” by the incident, but the people of Athens have taken to the streets yet again, with thousands flocking to the site of his death and many scuffling with police.

How the IMF causes riots to use as a tactic on behalf of private corporations to rape countries assests.

These types of protests aren’t merely predictable, they’re part of the plan. The IMF and World Bank documents that leaked out in 2001 detailed the four step plan for looting a country, including the “IMF riot” stage. People take to the streets to protest the austerity measures that are tied to the IMF loans, causing foreign capital to flee, governments to go bankrupt, and foreign speculators to pick up the pieces at fire sale prices. The riots happened in Indonesia in 1998. And Bolivia in 2000. And Ecuador and Argentina in 2001. What’s happening in Europe is not an exact analogue, and it’s aimed at centralizing power in the EU in Brussels and the ECB in Frankfurt, but that the IMF has seen the crisis as an excuse to get its foot in Europe’s door as a lender is particularly telling.

Bribed politicians do very well out of the collapse of their countries.

This is how the game is played and that’s why the politicians for the most part are happy to go along with it. After they serve their term in the cockpit, they jump out with a golden parachute and leave the people to crash in the flaming debt bubble the politicians have created. This is why Lagarde is likely to get her $500 billion, or something approximating it, including an extra $63 billion that the US is slated to start paying under a new quota agreement. And the band plays on.