Anti-euro movements were pushed aside or squashed by political establishments across the Eurozone. There is, for example, Marine Le Pen, of the right-wing FN in France—“Let the euro die a natural death,” is her mantra. Though she finished third in the presidential election, her party has next to zero influence in parliament. Austria has Frank Stronach, who is trying to get an anti-euro party off the ground, without much effect. Germany has the Free Voters, an anti-bailout party that has been successful in Bavaria but not on the national scene.

Then Italy happened. Two anti-austerity parties with no love for the euro, one headed by Silvio Berlusconi the other by Beppe Grillo, captured over half the vote—and locked up the political system. Newcomer Grillo had thrown the status quo into chaos, for better or worse. Suddenly, everyone saw that anger and frustration could accomplish something.

It stoked a fire in Germany. Chancellor Angela Merkel’s euro bailout policies—“There is no alternative,” is her mantra—hit increasing resistance, particularly in her own coalition, but wayward voices were gagged.

“Time has come,” Konrad Adam called out as a greeting to the crowd Monday night and reaped enthusiastic applause. Despite the snowy weather, over 1,200 people had shown up at the Stadthalle in Oberursel, a small town near Frankfurt, for the first public meeting of the just-founded association, Alternative for Germany (AfD), that isn’t even a political party yet, and that wants to be on the ballot for the federal elections on September 22.

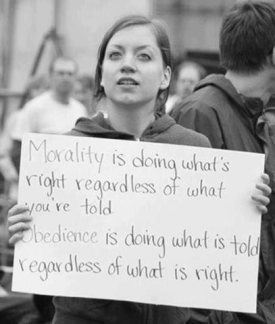

So Adam, one of the founders and a former editor at the Welt and FAZ, was pressed for time. It’s wrong to say there’s no alternative to the euro bailouts, he said. “Politics is nourished by alternatives.” He introduced his demands:

– Dissolution of the “coercive euro association.” An orderly end of the monetary union. Countries should be able to legally exit if they “could not, or did not want to remain.” The euro would be replaced by parallel national currencies or smaller, more stable monetary unions.

– Observance of the rule of law, specifically the laws laid out in the now totally flouted Maastricht Treaty that specified, for example, that no Eurozone member would guarantee the debts of other members.

– A referendum if “the basic law, the best constitution that Germany ever had,” were modified to allow the transfer of sovereignty to a centralized European state.

The event had been opened by co-founder Bernd Lucke, an economics professor who’d been a member of Merkel’s CDU for 33 years until he abandoned it in 2011 over her bailout policies. So he hammered her. “We have a government that has failed to comply with the law and the rules and the contracts, and that has blatantly broken its word that it had given to the German people,” he said to rousing applause.

But this wasn’t the radical fringe of Germany. The mood was enthusiastic and serious. The people weren’t so young anymore. Supporters, by now 13,000, were a well-educated bunch, with a higher concentration of PhDs than any party. Among the early supporters were prominent economics professors, ex-members of the CDU, and even Hans-Olaf Henkel, the former president of the Federation of German Industry (BDI), an umbrella lobbying organization representing 100,000 businesses. And so the event was orderly, a picture, as the Wirtschafts Woche described it, of the “German bourgeoisie.”

Many supporters hailed from the center-right CDU and FDP, but AfD didn’t want to be categorized in the classic scheme of left and right. “We represent non-ideological values that people of different views can share,” Lucke said.

A claim that was validated: 26% of Germans would consider voting for a party that would steer the country out of the monetary union. They came from all political directions: on the right, 17% of CDU voters and almost a third of FDP voters; on the left, 15% of SPD voters, 27% of Green voters, and 57% of Left voters.

The challenges are huge. One is fragmentation. It would be difficult to get people from that kind spectrum to agree on anything. Another is time. The founding convention will be on April 13 in Berlin. By June 17, the party and sections for each state must register with the federal election office. By July 15, the party must collect signatures in every state amounting to 0.1% of the electorate or 2,000, whichever is lower, just to get on the ballot. But Lucke was optimistic. “With you, we can easily get the signatures,” he told the crowd.

It will be tough. Merkel is immensely popular. The major parties are well-oiled political machines. The AfD lacks truly prominent personalities, experienced politicians, economically powerful supporters, financial resources, structure…. And its platform is still skimpy.

But it doesn’t need to govern. The parliament let itself be intimidated by the executive branch “through the assertion that there is no alternative,” Lucke said. When the AfD arrives in parliament, “it will cause the large parties to begin to rethink.” This would lead to “a critical questioning of the monetary union.” And to a look at the very alternatives that Merkel said didn’t exist.

There have been waves of threats by Eurozone politicians to bully people into accepting “whatever it takes” to keep the shaky monetary union glued together. These threats peaked last year with disorderly default, and when that wasn’t enough, with collapse of the Eurozone. But now, the ultimate threat has been pronounced: war. Read…. The Ultimate Threat In The Euro Bailout and Austerity Racket: War

EUROZONE banks are refusing to lend to peers in other countries in the common currency bloc, signalling a worrying fall in confidence that appears to have worsened since the Cyprus bailout earlier this year, data analysed by Reuters shows.