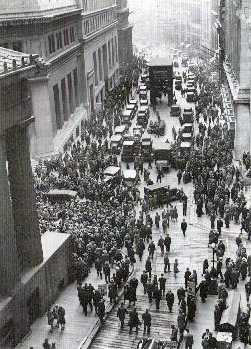

George Soros dumping 80% of his stock holdings might give a clue towards a stock market crash this year. The article below from Market Watch estimates a 87% probability with 10 predictions, but never underestimate Bernanke and the Fed to keep the show going. One thing is for sure its just a matter of time and will far worse than anything experience in 2008. You were warned.

In “Stocks for the Long Run,” economist Jeremy Siegel researched all the “big market moves” between 1801 and 2001. Bottom line: 75% of the time, there is no rationale for “big moves.” No one can predict them. Maybe technicians and traders can pick short-term moves the next second. Maybe tomorrow. But the long-term “big market moves?” No way.

So why predict an “87%” chance of another meltdown in 2013? Because in the real world of statistical probabilities, historical facts and expert opinions danger signals are flashing wild. In mid-2008 we summarized the predictions of 20 experts over several years. Predicted a meltdown in a few years — markets crashed two months later. Fast.

In retrospect, it was inevitable, thanks in part to the hype, arrogance and incompetence of Fed Chairman Ben Bernanke and Treasury Secretary Henry Paulson who failed to prepare America.

The warnings are again accelerating. And so is the happy talk from Wall Street casino insiders, about rallies, housing recoveries, perpetual cheap money. Don’t listen. The next crash will happen by year-end.

Yes, there’s a 13% chance the next Fed chairman will keep printing cheap money into 2014. But on New Years Eve our aging bull will be 4½ years old, well past Bill O’Neill’s “average” 3.75 years for putting this bull out to pasture.

So unless you’re shorting, all bets on Wall Street casinos for 2014 are megarisk, like 2008. Like a Stephen King horror film, you feel it coming. Could happen anytime, even tomorrow, says Siegel’s research, or the unpredictable logic in Nassim Taleb’s “Black Swan.”

Here are 10 other predictions adding credibility to a crash by the end of 2013:

1. Warren Buffett ‘guaranteed’ new bubble, new recession four years ago

Actually he saw it coming early. Shortly after the 2008 crash Warren Buffett was asked: “Do you think there will be another bubble leading to a huge recession?” Yes, “I can guarantee it.” Cycles happen.

Next question: “Why can’t we learn the lessons of the last recession? Look where greed has gotten us.” Then with the impish grin of a Zen master, Uncle Warren replied, “Greed is fun for a while. People can’t resist it.” But “however far human beings have come, we haven’t grown up emotionally at all. We remain the same.”

Yes, one of world’s richest men was personally guaranteeing another bubble, another “huge recession.” Now, four years later, that time bomb is ticking louder, closer.

2. Federal Reserve’s Council: ‘Unsustainable bubble in stocks, bonds’

The International Business Times just reported on the minutes of the Federal Reserve Board Advisory Council’s mid-May meeting. Members expressed “strong concerns over the Fed’s low-interest-rate policies and its bond-purchase program, which they say could trigger unmanageable inflation and an ‘unsustainable bubble’ in the stock and bond markets.” Some “pointed out that near-zero interest rates could not be sustained in the long run.”

Why? “A spike in inflation could force the Fed to hike interest rates, hurting business confidence and consumer spending, and prove disastrous to the U.S. economy, which is still clawing its way back from the debilitating effects of the 2008 financial crisis.”

Get it? The Fed and Wall Street insiders hear something’s dead ahead.

3. Peter Schiff is ‘doubling down’ on his ‘doomsday’ prediction

Euro Pacific Capital CEO Peter Schiff, author of “The Real Crash: America’s Coming Bankruptcy,” is “not backing away from doomsday predictions about the U.S. economy,” wrote MarketWatch’s Greg Robb last week. He sees the no-win scenario: “Either the Fed stops QE and starts selling the Treasurys and mortgage-related assets on its balance sheet, thus triggering a recession, or else faces an inevitable, even-worse, currency crisis.”

The “idea that the U.S. economy is in recovery is based entirely on rising asset prices … Asset prices are only rising because rates are low. As soon as rates go back up, asset prices will” fall.

Last year on Fox Business Schiff warned: “We’ve got a much bigger collapse coming.” Then last week: “I am 100% confident the crisis that we’re going to have will be much worse than the one we had in 2008.” His 100% beats our 87%.

4. Bill Gross: ‘Credit supernova’ turning 2013 bull into big bad bear

Yes, Gross sees a ‘credit supernova’ dead ahead. His firm has $2 trillion at risk when the Federal Reserve cheap money finally explodes in America’s face, brings down the economy, again. Gross warns: “Investment banking, which only a decade ago promoted small-business development and transition to public markets, now is dominated by leveraged speculation and the Ponzi finance.”

Bernanke’s Ponzi finance is self-destructive, lethal and massive. Endless cheap money upsets the balance between credit expansion and real economic growth, resulting in diminishing returns. Very bad news.

5. Gary Shilling predicts the ‘grand disconnect’ will trigger ‘shocker’

Yes, economist Gary Shilling predicts a “shocker” before the end of the year. Worse because investors are “paying little attention to weak and declining economies around the world, and concentrating on the flood of money being created by central banks.”

The “grand disconnect” is driving up stocks “while the zeal for yield, amidst low interest rates, benefited junk bonds and other low-quality debt.” Wall Street’s blowing a nasty new bubble, repeating the run-up to the 2008 crash.

6. ‘Kaboom ahead,’ an ‘ominous third phase’ of 2008 Meltdown

“Bond guru buying stocks. Sees ‘Kaboom’ Ahead,” shouted the Bloomberg Market headline about Jeffrey Gundlach, CEO of Doubleline Capital. Earlier he predicted the 2008 meltdown. But now he says the real damage is yet to come.

“The first phase of the coming debacle consisted of a 27-year buildup of corporate, personal and sovereign debt. That lasted until 2008.” Then cheap money “finally toppled banks and pushed the global economy into a recession, spurring governments and central banks to spend trillions of dollars to stimulate growth.” Next, an “ominous third phase,” a bigger crash, whose impact will far exceed the damage of 2008.

What’s he buying? Hard assets. Plus “sitting on cash,” waiting to scoop up more at “fire-sale” prices, “it’s worth waiting.”

7. ‘Tick, tick … boom!’ InvestmentNews sees bond crash dead ahead

A few months ago InvestmentNews front page is so powerful you can hear sirens on a flashing, warning in huge bold type: “Tick, tick … boom!” Their readers: 90,000 professional advisers who trust INews forecasts.

This was the biggest warning since 2008: “What will your clients’ portfolios look like when the bond bomb goes off?” Not “if” but “when.” Yes, they expect the bond bomb to explode soon.

Wake up, INews sees extreme dangers for millions of Americans who have “no idea what’s about to happen to them … Tick, tick … boom!”

8. Reagan’s budget director sees an ‘apocalypse … get out now’

Recently David Stockman warned of an economic “apocalypse” dead ahead, “arising from a rogue central bank that has abetted the Wall Street casino, crucified savers on a cross of zero interest rates and fueled a global commodity bubble that erodes Main Street living standards through rising food and energy prices … get out of the markets and hide out in cash.”

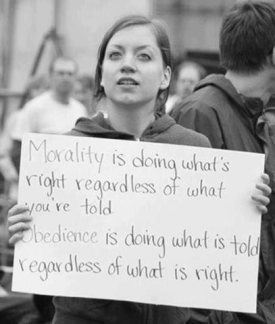

Stockman’s not merely warning of a crash ending the bull rally since 2009. This “grand bubble” has been building for 32 years since the Reagan revolution. He’s atoning for a generation of politicians with no moral compass: “Capitalism has morphed into a monopoly ruled by politicians who are serving a wealthy elite. Competition is a joke.”

9. Nouriel Roubini: ‘Prepare for the perfect storm’ in an unstable world

Yes, prepare, prepare, prepare. Roubini told Slate.com: Our world is a game of dominos, any one of which could put in motion a global collapse: “Sooner or later, another ugly fight” over debt, markets will “become spooked” with “a significant amount of drag … on an economy that has grown at barely a 2% rate.”

Scanning the world’s hot-button triggers in the euro zone, China, BRICs, Iran, Middle East, Pakistan, oil markets, Dr. Doom warns, the “drums of actual war will beat harder.” Any one of these trends “alone would be enough to stall the global economy and tip it into recession.”

10. Jeremy Grantham: America’s growth and prosperity ‘gone forever’

Grantham’s GMO firm manages $100 billion. He focused on Richard Gordon’s disturbing research: “Is U.S. Economic Growth Over?” Yes, says Grantham, “the U.S. GDP growth rate … is gone forever.”

For centuries before the Industrial Revolution growth was under 1%. Then the growth trend till “1980 was remarkable: 3.4% a year for a full hundred years,” driving the American dream. “But after 1980 the trend began to slip,” says Grantham,“ by over 1.5% from its peak in the 1960s and nearly 1% from the average of the last 30 years.” By 2100, America’s GDP growth will fall back to where it started before the Industrial Revolution, to an annual rate less than 1%.

Buffett guarantees … Schiff doubles down … Gross sees supernova … Shilling’s grand disconnect … Gundlach’s ominous third phase … Stockman’s apocalypse … InvestmentNews tick, tick, boom … Roubini’s perfect storm … Grantham’s growth gone forever … place your bets at Wall Street’s casinos … the risk’s only 87% … or is it 100%?

Source: MarketWatch